The forum covered both FG24/3: from the Financial Conduct Authority (FCA), “Finalised non-handbook guidance on the anti-greenwashing rule (AGR) and the Transition Plan Taskforce’s Disclosure Framework and Asset Owner Sector Guidance. It started with an overview of the challenges and limitations of climate scenarios followed by an overview of the greenwashing guidance. It then covered the Transition Plan Framework before reviewing the operational and compliance implications.

We have summarised each section in turn, including a key slide, followed by some highlights from the ensuing and broad-reaching discussions, closing with some recommendations and next steps.

Climate scenario limitations and IFoA risk alert

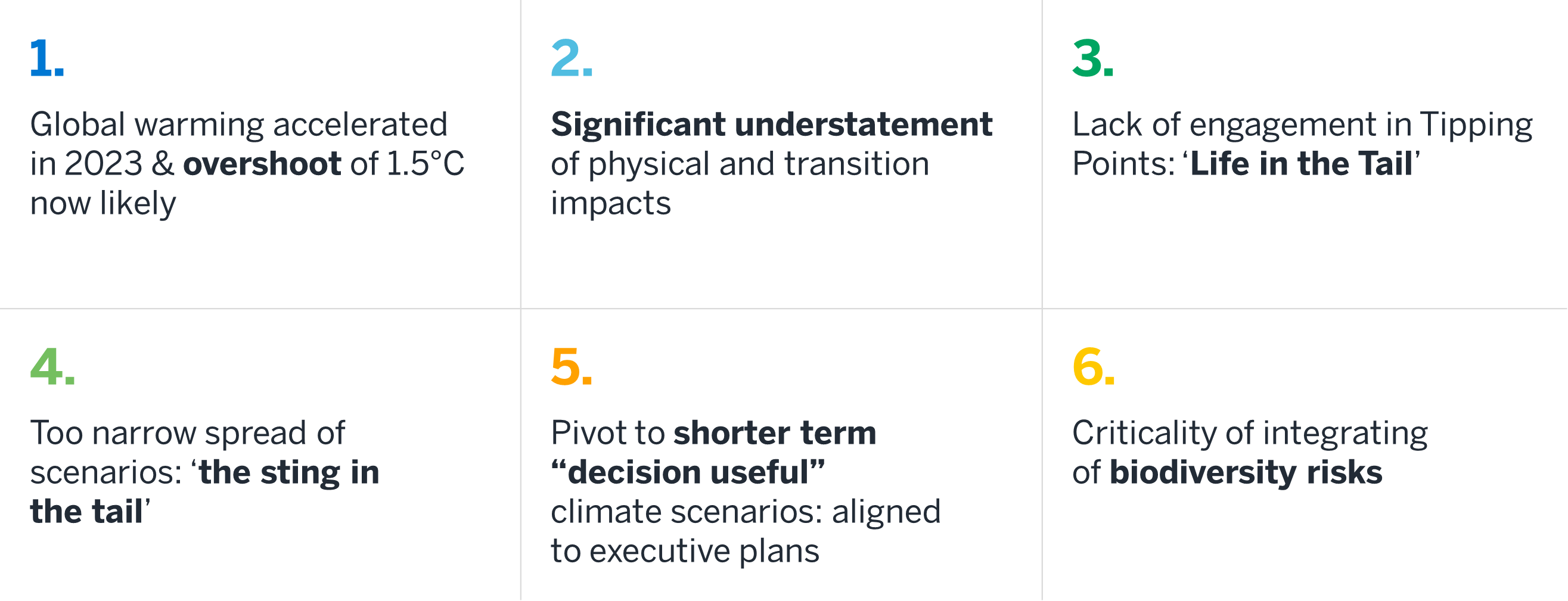

Published climate scenarios, such as those from the Network for Greening the Financial System (NGFS) or the International Energy Agency (IEA), often fail to capture the full spectrum of complexities, uncertainties and tail risks associated with climate change. These shortcomings are covered in recent papers from the Institute and Faculty of Actuaries (IFoA) and highlighted in its June 2024 risk alert. Whilst the risk alert only directly refers to the responsibilities of IFoA actuaries, we believe the core message applies to all organisations. The alert states that actuaries should not only seek to understand the limitations of climate scenarios but should also effectively communicate the limitations and uncertainties. Key messages from the IFoA papers are summarized in Figure 1.

Figure 1: Key messages from recent IFOA papers

Source: IFoA, Milliman.

Planet reality and nature decline

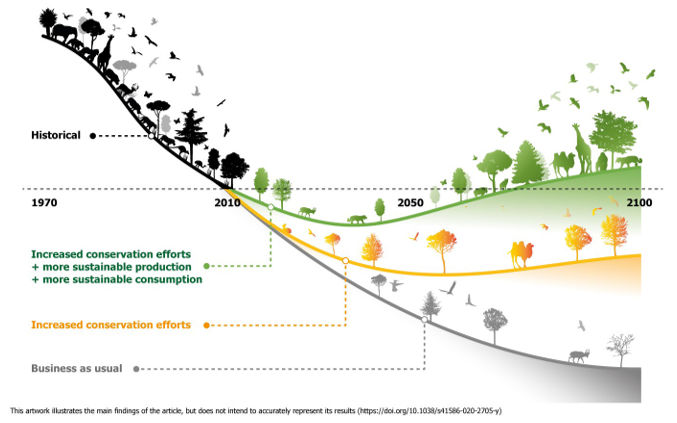

An often-overlooked element of sustainability risks is attention to biodiversity and nature risks. There has been an alarming decline in nature, evidenced by a 73% drop in wildlife populations since 1970 and extinction rates far exceeding the typical, prehuman levels. The impacts, and potential futures, were illustrated in an article from the International Institute for Applied Systems Analysis (IIASA), “Bending the curve of biodiversity loss,” included with permission in Figure 2.

Figure 2: Bending the curve of biodiversity loss

Source: © Adam Islaam | IIASA.

The economic ramifications of these environmental changes are becoming increasingly evident. The recent report from the Green Finance Initiative, “Assessing the Materiality of Nature-Related Financial Risks for the UK” states that nature-related risks present an equal if not greater risk to the UK economy over the next 10 years than climate change risks. Nature-related risks are those that are linked to the direct and societal dependencies on nature and to nature impacts. The report showed that they have the potential to result in impacts as large as the global financial crisis or, in a stress scenario, the COVID-19 pandemic. Moreover, there is increasing recognition that “you can’t be net zero without being nature positive.” Yet few, if any, financial service firms are paying equal attention to nature-related risk as to climate-related risks.

Greenwashing and regulatory compliance

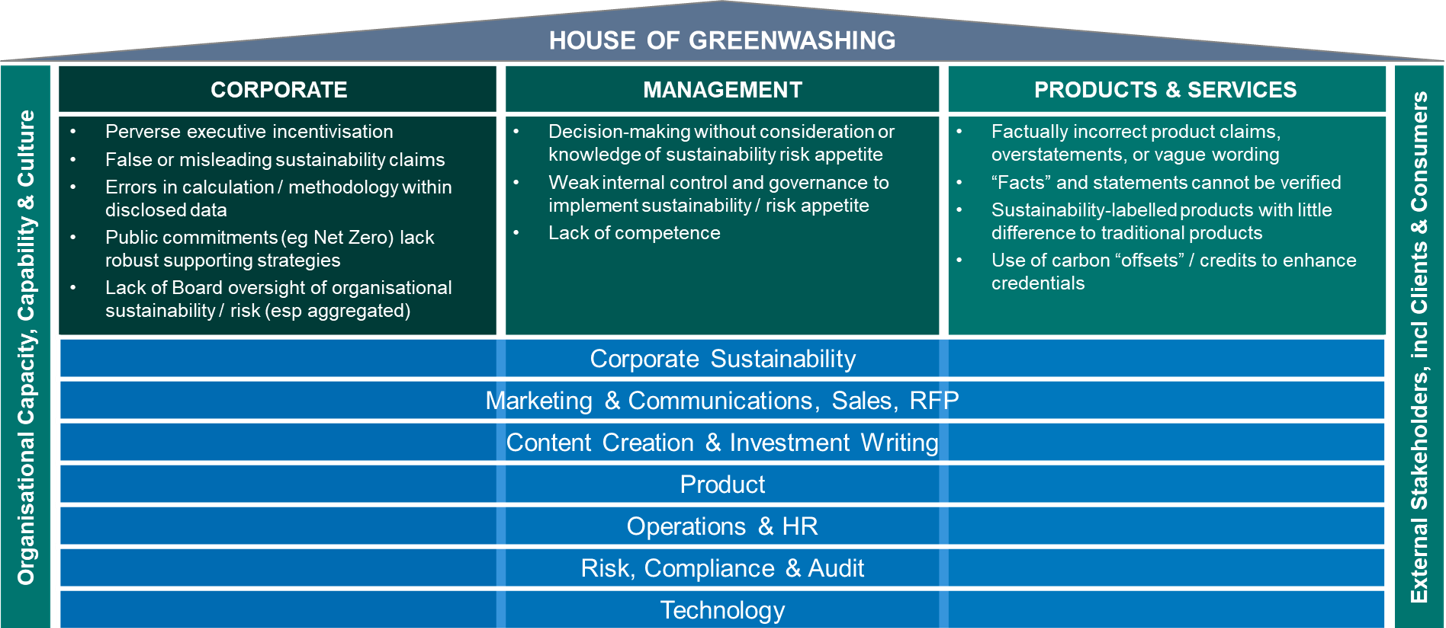

The FCA finalised the FG24/3 Anti-Greenwashing Rule (AGR) guidance in May 2024. Greenwashing, or the practice of making misleading sustainability claims, is a major regulatory and reputational risk. Pinsent Masons’ "House of Greenwashing" framework (Figure 3) provides a stylistic view of where greenwashing can appear in an organisation and illustrates the foundations required to mitigate the risk of greenwashing.

Figure 3: House of greenwashing

Source: Pinsent Masons.

Enforcement action brought by regulators has emphasised failures within internal processes, behaviour, and conduct—mostly inadvertent. Identifying where an organisation is most at risk of greenwashing, or where there might be material failures, requires reviews to be carried out across a number of different areas.

Climate transition plans

The Transition Plan Taskforce (TPT) was created to establish the best practice, “gold standard” for effective climate transition plans. It has developed sector-specific guidance for both asset owners and managers covering their strategies and objectives across investment, engagement, products and operations. In this way, the finance sector can act as a lever for, and an accelerator of, climate transition.

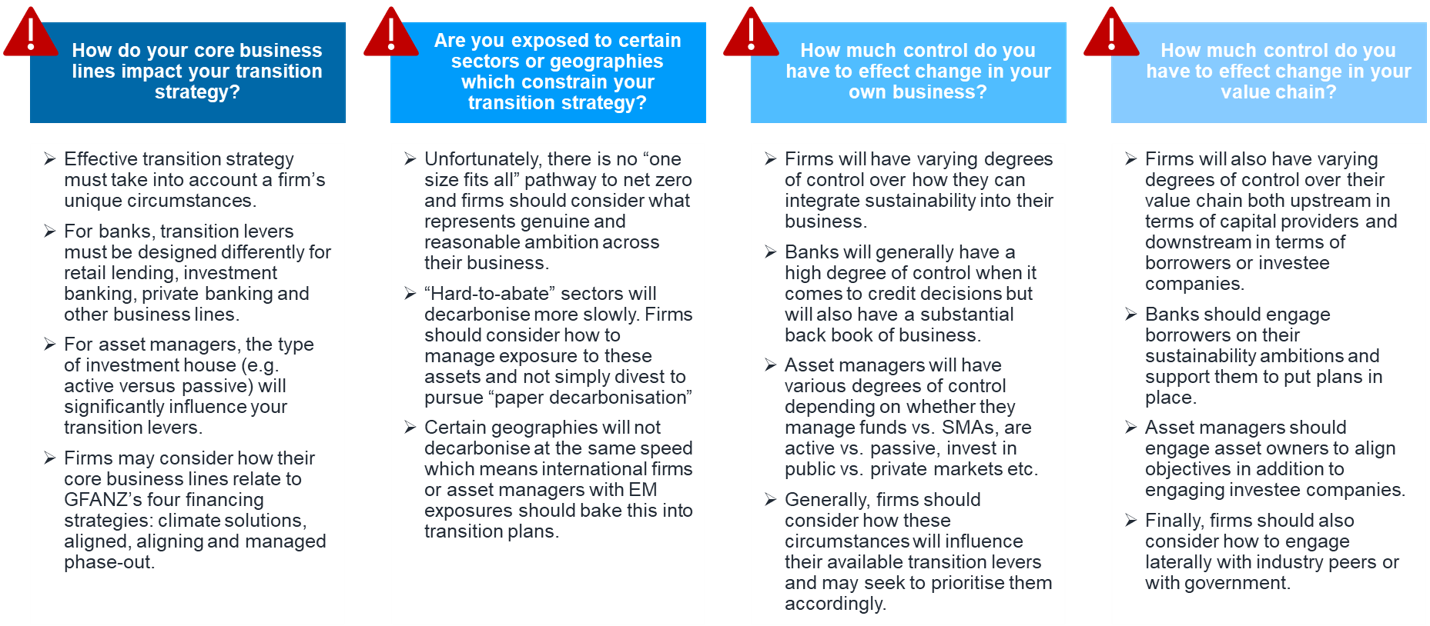

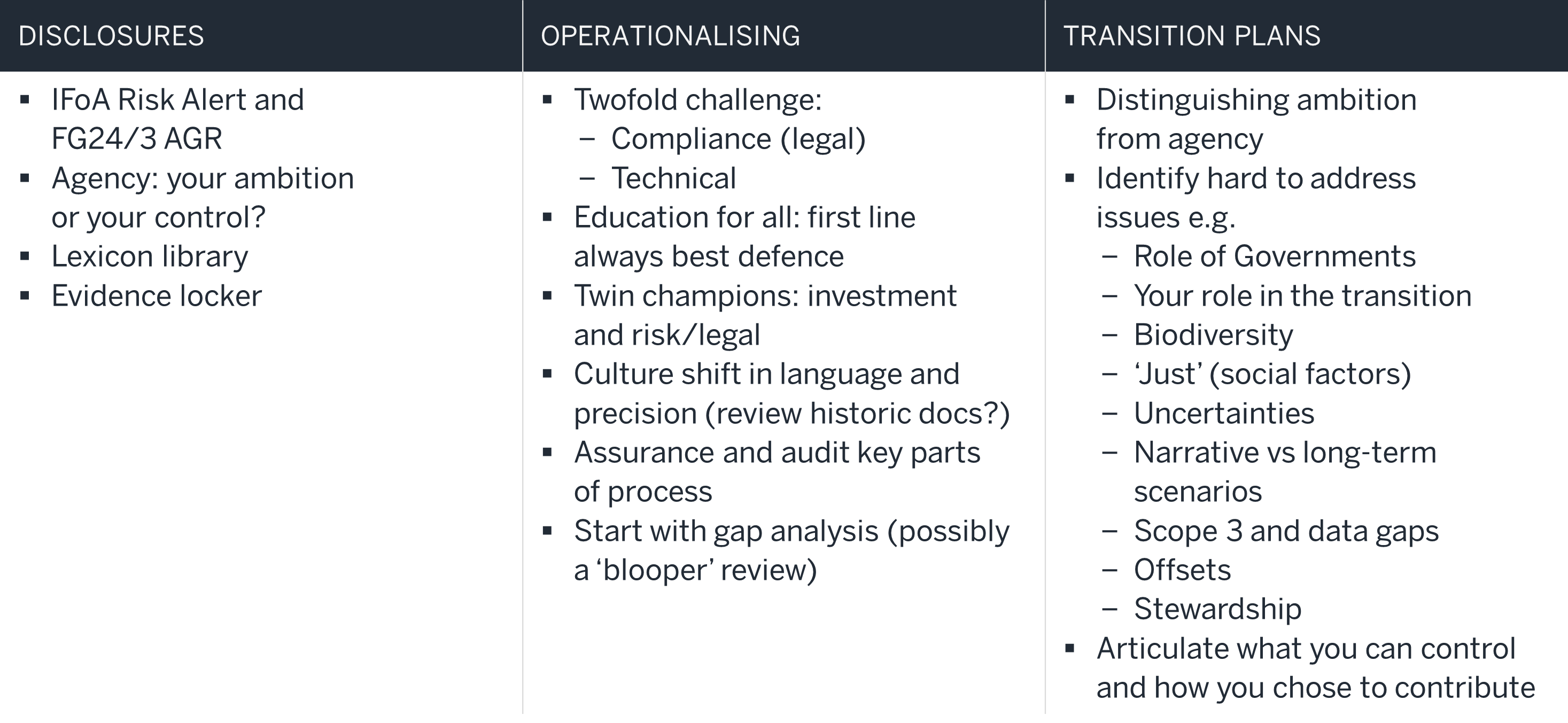

Whilst the principles and focus are quite intuitive, addressing the practicalities in the detail can highlight some of the challenges, as shown in Figure 4.

Figure 4: Addressing the practicalities of transition plans

Source: Pinsent Masons.

Operational and compliance implications

The challenges of operationalising the FCA’s “anti-greenwashing rule” and the TPT’s transition plan guidance arises from the multifaceted approach that is needed. Work needs to blend both compliance (legal) requirements with the technical “planet reality” and investment detail. The detail is deep. For example, those responsible need to understand that “supermarkets” may not be free of fossil fuels if they own petrol stations, and such forensic attention must be applied to every investment.

Disclosures are natural areas for attention to greenwashing compliance. However, the FCA’s greenwashing illustrations, such as the example of supermarkets with petrol stations, shows the level of diligence required to make sustainability claims. Verifying claims requires in-depth insight and access to information dispersed across an organisation—well beyond what is usually available to a compliance team. Instead, it’s necessary to have a culture shift where the whole organisation embraces the requirements and aligns efforts across multidisciplinary teams.

Figure 5: Disclosures, operations and transition plans

Source: Milliman.

Note: Lexicon library is an internal glossary to provide consistent use of terminology across an organisation. An evidence locker keeps the evidence for green claims stored in a single place and thus able to be reviewed on a regular basis.

While disclosures do require specific attention, broader efforts need to be made in operationalising compliance. Given the backdrop of the challenges and uncertainties of a net zero transition, it is important to reflect on transition plans with humility. Transition plans should distinguish between ambitions of goals and what is within an organisation’s agency to affect. Identifying the ”hard to address” areas will help to both refine the plans and align them with realisable goals.

Highlights from the discussions

Two roundtables followed the presentations, and we have summarised the discussions below. As an open discussion, these are views of the participants and may not reflect the positions of all organisations.

Challenges in scenario planning and board engagement: Companies often struggle presenting climate scenarios to their boards of directors due to the uncertainty and complexity of climate models. Confidence is further undermined if the outcomes are seen as generic and too far into the future. Boards have a strong preference for clear, quantitative outputs, whilst, in practice, models need to address large uncertainties. Some of these challenges can be addressed by pivoting to focus on “no regret” actions based on the directional implications of models rather than their precise quantifications. Scenario planning that builds narrative outcomes that plausibly impact key executive indicators almost always gets the board’s attention. Using current situations, e.g., impacts of a recent political election, can also help board discussion and engagement.

Regulatory uncertainty and greenwashing risks: The regulatory actions on greenwashing remain uncertain with the potential for regulators to focus on a “large name” (or names) alongside a broader sweep. There are heightened regulatory and reputational risks until regulators’ expectations and industry practice become clearer. A participant highlighted that recent regulations in Canada have led to companies withdrawing or reducing their sustainability disclosures out of greenwashing fears. Ongoing clear and supportive regulatory guidance, with identification of ”safe havens”, can help counteract this "green gag" effect.

Climate-related disclosures and ESG scores: There is a shift towards qualitative disclosures in the Task Force on Climate-related Financial Disclosures (TCFD), focusing on analysis and actions rather than just numerical data. This may reflect a deeper understanding in the challenges and limitations of the models. This also highlights that, on a practical basis, the key is not the numbers, it’s how this analysis is understood and acted upon. The accuracy of aggregated environmental, social, and corporate governance (ESG) scores is also under scrutiny and regulatory review. From a disclosure point of view, it is both providing clarity and context for the ratings used along with ensuring that ”green” claims or expectations can be justified from the approach used.

Transition planning and biodiversity integration: The Japanese government's advanced transition was highlighted as a model for other governments. It enables businesses to plan and finance their efforts based on clear expectations for the decarbonisation of the economy. Integrating biodiversity and social risks into such sustainability planning is still in development. But the growth of National Biodiversity Strategies and Action Plans (NBSAPs) should help this—albeit only 44 nations completed these ahead of the October 2024 Biodiversity COP16 deadline. The UK Mansion House Compact and recent Mansion House speech are examples of ongoing UK efforts to engage with social risk and local economy aspects.

Engaging on the opportunities: Finally, we all noted that boards often prefer to focus on opportunities rather than risks. One of the strategic risks to the company is its ability to address fundamental transitions—but risks and transitions can also be investigated for opportunities. A focus on potential rapid shifts in consumer demands, and thus new product opportunities, can help board engagement.

Recommendations and next steps

The forum closed with five recommended actions as immediate next steps for greenwashing and transition planning:

- Conduct systematic gap analyses: Identify and address gaps in current sustainability practices and compliance with new regulations.

- Establish robust policies and assurance processes: Develop and implement policies that ensure accurate and transparent sustainability reporting.

- Create a lexicon library and evidence locker: Maintain a repository of standardised terminology and a regularly reviewed library of supporting evidence for sustainability claims.

- Operationalise first-line ownership with second-line support: Foster a “culture of accountability” where the first line of defence owns sustainability risks, supported by the second line.

- Get started on a transition plan: Working through the detail will throw up challenges, but help to grapple with the true risks, opportunities and tensions the transition will create as well as help identify areas where your organisation can make a difference.

We hope this note serves as a helpful review of the forum. We would like to thank Hayden Morgan, James Hay and Dominique Gonsalves at Pinsent Masons for their hosting, collaboration and shared insights in a topic that combines technical, legal, governance and operational perspectives.

Please let the Milliman and Pinsent Masons teams know if you have any questions, on this or broader topics, and if you would like to participate in future forums. We really appreciated the high interest and engaged discussion by participants. We hope to see you at the next forum.

1 FCA (23 April 2024). FG24/3: Finalised non-handbook guidance on the anti-greenwashing rule. Retrieved 5 January 2025 from https://www.fca.org.uk/publications/finalised-guidance/fg24-3-finalised-non-handbook-guidance-anti-greenwashing-rule.

2 International Transition Plan Network. TPT Legacy. Retrieved 5 January 2025 from https://itpn.global/tpt-legacy/.

3 Trust, S., Joshi, S., Lenton, T. & Oliver, J. (July 2023). The Emperor’s New Climate Scenarios: Limitations and assumptions of commonly used climate-change scenarios in financial services. IFoA. Retrieved 5 January 2025 from https://actuaries.org.uk/media/qeydewmk/the-emperor-s-new-climate-scenarios.pdf.

4 IFoA (6 June 2024). Risk Alert: Climate Change Scenario Analysis. Retrieved 5 January 2025 from https://actuaries.org.uk/media/ue4hdq3l/risk-alert-climate-change-scenario-analysis.pdf .

5 World Wildlife Fund (2024). Living Planet Report 2024. Retrieved 5 January 2025 from https://livingplanet.panda.org/en-GB/ .

6 Leclere D. & Heyl A. (10 September 2020). Bending the curve of biodiversity loss. IIASA. Retrieved 5 January 2025 from https://iiasa.ac.at/news/sep-2020/bending-curve-of-biodiversity-loss .

7 Green Finance Institute (April 2024). Assessing the Materiality of Nature-Related Financial Risks for the UK. Retrieved 5 January 2025 from https://www.greenfinanceinstitute.com/wp-content/uploads/2024/06/GFI-GREENING-FINANCE-FOR-NATURE-FINAL-FULL-REPORT-RDS4.pdf .

8 Marshall, J. (6 February 2023). How to be nature positive: The only route to net zero. CBI. Retrieved 5 January 2025 from https://www.cbi.org.uk/articles/how-to-be-nature-positive-the-only-route-to-net-zero/ .

12 HM Treasury (14 November 2024). Future regulatory regime for Environmental, Social, and Governance (ESG) ratings providers. Retrieved 5 January 2025 from https://www.gov.uk/government/consultations/future-regulatory-regime-for-environmental-social-and-governance-esg-ratings-providers .

13 The Global City (10 July 2023). Mansion House Compact. Retrieved 5 January 2025 from https://www.theglobalcity.uk/insights/mansion-house-compact .

14 HM Treasury (15 November 2024). Mansion House 2024. Retrieved 5 January 2025 from https://www.gov.uk/government/collections/mansion-house-2024 .