News & events

News

-

The 2018 Captive Review Power 50

19 February 2019 Captive Review

Joel Chansky was named to the Captive Review Hall of Fame. The Hall of Fame was introduced in 2016 and celebrates the most influential individuals the captive insurance industry has produced or been served by over the past 50 years.

-

Florence flood threat heightened by underinsured homeowners

14 September 2018 Wall Street Journal

According to Milliman estimates, fewer than 10% of the households likely affected by Hurricane Florence in the Carolinas have flood insurance.

-

Milliman named actuarial firm winner by this year’s U.S. Captive Review Awards

13 August 2018 Captive.com

These awards recognize captive insurance products and services providers offering high levels of excellence over the past year.

-

Seattle Symphony, musicians announce four year contract extension

27 March 2018 The Seattle Symphony

The Seattle Symphony becomes the first orchestra to adopt the Milliman Sustainable Income Plan™ (SIP) on behalf of its musicians.

-

Reuters: What happened yesterday was just a very small blip

07 February 2018 Reuters

Rebecca Sielman says an important component in calculating funding for nearly all public retirement systems is smoothing out gains and losses over a four- to five-year period.

Press releases

- Milliman analysis: Estimated cost of retiree pension risk transfer as low as 100.3% in October, under competitive pricing rate

17 November 2020

Milliman, Inc., a premier global consulting and actuarial firm, today announced the latest results of its Milliman Pension Buyout Index (MPBI). As the Pension Risk Transfer (PRT) market continues to grow, it has become increasingly important to monitor the annuity market for plan sponsors that are considering transferring retiree pension obligations to an insurer.

- Milliman analysis: Corporate pension funded status improves by $21 billion in October

5 November 2020

Milliman, Inc., a premier global consulting and actuarial firm, today released the results of its latest Pension Funding Index (PFI), which analyzes the 100 largest U.S. corporate pension plans.

- Milliman analysis: Mortgage default risk drops in Q2 2020, despite pandemic, due to home price growth and refinance volume

5 November 2020

Milliman, Inc., a premier global consulting and actuarial firm, today announced the second quarter 2020 results of the Milliman Mortgage Default Index (MMDI), which shows the latest monthly estimate of the lifetime default risk of U.S.-backed mortgages.

- Milliman expands Pension Buyout Index to include competitive pricing rate, which drops to 100.2% in September

3 November 2020

Milliman, Inc., a premier global consulting and actuarial firm, today announced the latest results of its Milliman Pension Buyout Index (MPBI). As the Pension Risk Transfer (PRT) market continues to grow, it has become increasingly important to monitor the annuity market for plan sponsors that are considering transferring retiree pension obligations to an insurer.

- Milliman to begin operating in Sri Lanka, acquires consulting firm

2 November 2020

Milliman, Inc., a premier global consulting and actuarial firm, announced that it will begin operations in Sri Lanka after an agreement to acquire Colombo-based Spark Actuarial Private Limited came into effect today.

- Milliman launches AccuRate Fleet at InsureTech Connect 2020, introducing new telematics-based risk score for commercial auto insurers, MGAs, and start-ups

20 October 2020

Milliman, Inc., a premier global consulting and actuarial firm, today announced a new innovation in the insurtech space: AccuRate Fleet, a telematics-based risk score created with Azuga, Inc. to help improve commercial auto insurer profitability.

- Individual disability income (IDI) market reports low overall growth in 2019, according to Milliman

16 October 2020

Milliman, Inc., a premier global consulting and actuarial firm, today released the results of its latest Individual Disability Income (IDI) Market Survey.

- Milliman strengthens hedging and overlay solutions with MatchingLink software

13 October 2020

Milliman, Inc., a premier global consulting and actuarial firm, is pleased to announce that Milliman has chosen MatchingLink software to enhance its hedging and overlay solutions.

- Milliman analysis: Corporate pension asset values drop in September for the first time in six months, funded ratio dips to 84.5%

6 October 2020

Milliman, Inc., a premier global consulting and actuarial firm, today released the results of its latest Pension Funding Index (PFI), which analyzes the 100 largest U.S. corporate pension plans.

- New Milliman survey reveals significant repricing of long-term care hybrid products in the last 12 months

30 September 2020

Milliman, Inc., a premier global consulting and actuarial firm, today released the results of a new survey examining changes to hybrid long-term care (LTC) plans in light of the low interest rate environment and COVID-19.

- Milliman analysis: Estimated cost of retiree pension risk transfer increases from 102.8% to 103.2% in August

22 September 2020

Milliman, Inc., a premier global consulting and actuarial firm, today announced the latest results of its Milliman Pension Buyout Index (MPBI).

- Milliman’s strategic cyber risk assessment now available in the Microsoft Azure Marketplace

18 September 2020

Milliman, Inc., a premier global consulting and actuarial firm, today announced that it has launched its Strategic Cyber Risk Assessment in the Microsoft Azure Marketplace to help organizations better understand, map, and measure their cyber and other operational risks.

- Milliman adds Morningstar advisor managed accounts to retirement administration services

9 September 2020

Milliman announced that it has added Morningstar advisor managed accounts to its retirement plan administration services. Advisor managed accounts allows a plan’s registered investment adviser (RIA) to create personalized investment portfolios for participants through Morningstar Investment Management LLC’s technology platform.

- Milliman analysis: Corporate pensions improve by $93 billion in August, second-largest monthly increase in 20 years

9 September 2020

Milliman, Inc., a premier global consulting and actuarial firm, today released the results of its latest Pension Funding Index (PFI), which analyzes the 100 largest U.S. corporate pension plans.

- Milliman study: Insurers across Asia report double-digit embedded value growth through 2019

28 August 2020

Milliman today announced the findings of its annual study on reported year-end 2019 embedded value (EV) and value of new business (VNB) results for 53 major multinational and domestic life insurers across Asia.

- Milliman awards 17 Opportunity Scholarships in program’s fourth year

27 August 2020

Milliman, Inc., a premier global consulting and actuarial firm, is pleased to announce the recipients of this year’s Opportunity Scholarship program.

- Milliman analysis: Estimated cost of retiree pension risk transfer decreases from 104.2% to 102.8% in July

25 August 2020

Milliman, Inc., a premier global consulting and actuarial firm, today announced the latest results of its Milliman Pension Buyout Index (MPBI). As the Pension Risk Transfer (PRT) market continues to grow, it has become increasingly important to monitor the annuity market for plan sponsors that are considering transferring retiree pension obligations to an insurer.

- Milliman acquires Torch Insight, expanding industry’s leading portfolio of SaaS health market intelligence solutions

18 August 2020

Milliman, Inc. today announced the acquisition of Torch Insight® from Leavitt Partners, LLC. This acquisition will combine Torch Insight’s powerful market-centered data and analytics with MedInsight, Milliman’s flagship healthcare analytics ecosystem.

- Milliman adds J.P. Augeri to global retirement and benefits team

12 August 2020

Milliman, Inc., a premier global consulting and actuarial firm, today announced the addition of John-Paul Augeri to its global retirement and benefits team. Augeri will be responsible for providing multinational employers with comprehensive employee benefit solutions.

- Milliman analysis: Multiemployer pension plans experience dramatic funding swings in the first half of 2020 due to COVID-19 and market volatility

11 August 2020

Milliman, Inc., a premier global consulting and actuarial firm, today released the results of its Multiemployer Pension Funding Study (MPFS) as of June 30, 2020, which analyzes the funded status of all multiemployer defined benefit pension plans in the United States.

- Milliman analysis: Another all-time low discount rate causes corporate pension funded ratio to plummet to 81.1% in July

10 August 2020

Milliman, Inc., a premier global consulting and actuarial firm, today released the results of its latest Pension Funding Index (PFI), which analyzes the 100 largest U.S. corporate pension plans.

- Milliman analysis: Increased economic risk from COVID-19 puts pressure on mortgage performance in 2020 Q1, but losses not expected to rise to global financial crisis level

4 August 2020

Milliman, Inc., a premier global consulting and actuarial firm, today announced the first quarter 2020 results of the Milliman Mortgage Default Index (MMDI), which shows the latest monthly estimate of the lifetime default risk of U.S.-backed mortgages. Default risk is driven by various factors including the risk of a borrower taking on too much debt, underwriting risk (such as loan term, loan purpose, and other influential mortgage features), and economic risk as measured by historical and forecast home prices. The goal of the MMDI is to provide a benchmark to understand trends in U.S. mortgage credit risk.

- Milliman analysis: Estimated cost of retiree pension risk transfer rises from 103.9% to 104.6% in June

30 July 2020

Milliman, Inc., a premier global consulting and actuarial firm, today announced the latest results of its Milliman Pension Buyout Index (MPBI). As the Pension Risk Transfer (PRT) market continues to grow, it has become increasingly important to monitor the annuity market for plan sponsors that are considering transferring retiree pension obligations to an insurer.

- New modeling and allocation capabilities in Milliman’s Arius solutions provide richer analysis and reporting

24 July 2020

Milliman, Inc., a premier global consulting and actuarial firm, announced today that it has released version 2020b of its Arius® solutions, a family of state-of-the-art reserve analysis systems for property and casualty insurers.

- Milliman analysis: Corporate pension funded ratio at 83.7% in June as discount rate hits historic low

13 July 2020

Milliman, Inc., a premier global consulting and actuarial firm, today released the results of its latest Pension Funding Index (PFI), which analyzes the 100 largest U.S. corporate pension plans.

- Milliman analysis: Public pensions rebound in Q2 with $308 billion asset gain

10 July 2020

Milliman, Inc., a premier global consulting and actuarial firm, today released the second quarter 2020 results of its Public Pension Funding Index (PPFI), which consists of the nation’s 100 largest public defined benefit pension plans.

- Milliman wins three InsuranceERM Americas Awards for its insurtech products and risk consulting services

24 June 2020

Milliman, Inc., a premier global consulting and actuarial firm, is pleased to announce that the firm has won three 2020 InsuranceERM Americas Awards for its insurtech products and risk consulting services. The goal of the IERM Americas Awards is to highlight enterprise risk management leaders in the Americas.

- Milliman analysis: Estimated cost of retiree pension risk transfer drops significantly, from 105.5% to 103.9% in May

23 June 2020

Milliman, Inc., a premier global consulting and actuarial firm, today announced the latest results of its new Milliman Pension Buyout Index (MPBI). As the Pension Risk Transfer (PRT) market continues to grow, it has become increasingly important to monitor the annuity market for plan sponsors that are considering transferring retiree pension obligations to an insurer.

- Milliman analysis: Economic recovery for public pensions continues in May, with funded ratio climbing back to 71.3%

11 June 2020

Milliman, Inc., a premier global consulting and actuarial firm, today released a special May edition of its Public Pension Funding Index (PPFI) in light of the COVID-19 pandemic and resulting market volatility. Milliman’s PPFI consists of the nation’s 100 largest public defined benefit pension plans.

- Milliman announces acquisition of healthIO to offer powerful preventive health solution to employers

10 June 2020

Milliman, Inc., a premier global consulting and actuarial firm, announced the acquisition of health technology startup healthIO, and the launch of Milliman healthIO, an innovative combination of Milliman’s predictive health analytics and healthIO’s preventive health technology. This product offering aims to make healthcare preventive, predictive and participative. It focuses on the healthcare consumer and their health advocacy group, to acquire longitudinal data on the consumer during the many hours that they spend away from the healthcare system. Algorithmic analysis of this data pattern allows for prediction of high cost health events as well as early involvement of health advocacy groups in the care of the consumer.

- Milliman analysis: Corporate pension funding deficit grows to $306 billion in May as discount rates neared all-time lows

8 June 2020

Milliman, Inc., a premier global consulting and actuarial firm, today released the results of its latest Pension Funding Index (PFI), which analyzes the 100 largest U.S. corporate pension plans. In May, the PFI funding deficit grew to $306 billion as discount rates dropped to 2.76%, nearing all-time index lows and offsetting positive investment gains for the month.

- Annual Milliman survey reveals a significant shift in sales from universal life insurance to indexed universal life insurance

26 May 2020

Milliman, Inc., a premier global consulting and actuarial firm, today released the results of its annual comprehensive study of universal life (UL) and indexed universal life (IUL) issues. The 13th annual Milliman study, “Universal Life and Indexed Universal Life Issues,” is based on a survey of 30 UL/IUL companies.

- Milliman Medical Index: Healthcare costs reach $6,553 for the average American, $28,653 for hypothetical family of four

21 May 2020

Milliman, Inc., a premier global consulting and actuarial firm, today released the 2020 Milliman Medical Index (MMI), which measures healthcare costs for individuals and families receiving coverage from an employer-sponsored preferred provider plan (PPO).

- Milliman analysis: Estimated cost of retiree pension risk transfer drops slightly from 105.7% to 105.5% in April

18 May 2020

Milliman, Inc., a premier global consulting and actuarial firm, today announced the latest results of its new Milliman Pension Buyout Index (MPBI). As the Pension Risk Transfer (PRT) market continues to grow, it has become increasingly important to monitor the annuity market for plan sponsors that are considering transferring retiree pension obligations to an insurer.

- Milliman analysis: Despite investment gains, corporate pensions’ funded ratio drops to 84.0% in April

15 May 2020

Milliman, Inc., a premier global consulting and actuarial firm, today released the results of its latest Pension Funding Index (PFI), which analyzes the 100 largest U.S. corporate pension plans. In April, corporate pensions saw their funding ratios decline as discount rates dropped below 3%, nearing all-time PFI lows and offsetting positive investment gains for the month.

- Milliman analysis: April market rebound helps public pensions recover half of Q1 losses, with $200 billion funding improvement

13 May 2020

Milliman, Inc., a premier global consulting and actuarial firm, today released a special April edition of its Public Pension Funding Index (PPFI), in light of the COVID-19 pandemic and resulting market volatility. Milliman’s PPFI consists of the nation’s 100 largest public defined benefit pension plans.

- New insurtech product, Milliman PinPoint, selected by North Carolina Rate Bureau to deliver granular flood rating plan

6 May 2020

Milliman, Inc., a premier global consulting and actuarial firm, today announced the launch of Milliman PinPoint, an innovative insurtech software solution that enables insurers to cost-effectively evaluate, price, and market residential property and flood products through location-level geospatial information that is customizable for each unique user.

- Milliman analysis: Default risk remained low through 2019 Q4, but economic volatility from COVID-19 will put pressure on mortgage performance

1 May 2020

Milliman, Inc., a premier global consulting and actuarial firm, today announced the fourth quarter 2019 results of the Milliman Mortgage Default Index (MMDI), which shows the latest monthly estimate of the lifetime default risk of U.S.-backed mortgages.

- Milliman Wins Prestigious 2020 Gold Quill Award

29 April 2020

Milliman recently won a 2020 Gold Quill Award in Human Resources and Benefits Communication from the International Association of Business Communicators (IABC). Milliman received the award for its “Benefits = Coverage You Can Count On” Open Enrollment campaign, a new benefits brand designed to play off the firm’s actuarial roots.

- Milliman analysis: Corporate pension funding ratio at 87.5% at 2019 year-end despite best asset performance in 16+ years

28 April 2020

Milliman, Inc., a premier global consulting and actuarial firm, today released the results of its 2020 Corporate Pension Funding Study (PFS), which analyzes the 100 largest U.S. corporate pension plans. In 2019, these plans experienced their second-highest asset performance in PFS history, with aggregate gains of 17.3% – second only to 2003’s investment return of 19.5%.

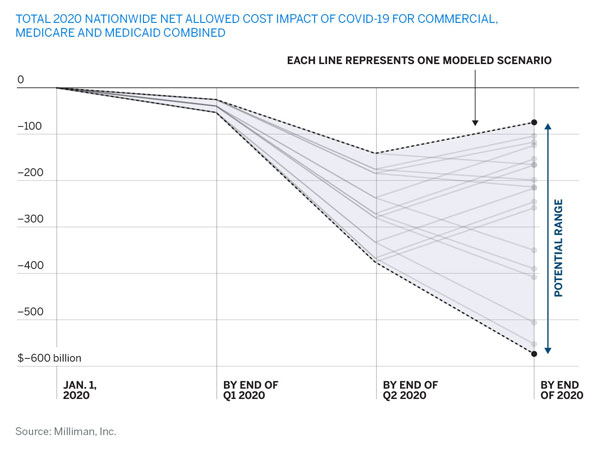

- Milliman projects COVID-19 pandemic could reduce 2020 U.S. healthcare expenditures by $75 billion to $575 billion

23 April 2020

Milliman, Inc., a premier global consulting and actuarial firm, released a report today projecting the COVID-19 pandemic will reduce U.S. nationwide healthcare expenditures by at least $75 billion and by as much as $575 billion in 2020. The report, “Estimating the financial impact of COVID-19 on 2020 healthcare costs,” models 18 different scenarios with varying infection rates and durations of care deferral.

- Milliman analysis: Estimated cost of retiree pension risk transfer rises from 105.2% to 105.7% in March

22 April 2020

Milliman, Inc., a premier global consulting and actuarial firm, today announced the latest results of its new Milliman Pension Buyout Index (MPBI). As the Pension Risk Transfer (PRT) market continues to grow, it has become increasingly important to monitor the annuity market for plan sponsors that are considering transferring retiree pension obligations to an insurer. The MPBI uses the FTSE Above Median AA Curve, along with annuity purchase composite interest rates from insurers, to estimate the average cost of a PRT annuity de-risking strategy.

- Milliman analysis: Corporate pensions see surprising $93 billion funding gain in March from massive discount rate surge

7 April 2020

Milliman, Inc., a premier global consulting and actuarial firm, today released the results of its latest Pension Funding Index (PFI), which analyzes the 100 largest U.S. corporate pension plans. Corporate pensions in March experienced a $93 billion increase in funded status, despite deteriorating economic conditions and in the midst of the global COVID-19 pandemic that brought heavy investment losses. Between February 29 and March 31, the Milliman 100 PFI funded ratio climbed from 82.1% to 85.6%.

- Milliman analysis: Estimated cost of retiree pension risk transfer climbs from 104.6% to 105.2% in February

31 March 2020

Seattle - Milliman, Inc., a premier global consulting and actuarial firm, today announced the latest results of its new Milliman Pension Buyout Index (MPBI). As the Pension Risk Transfer (PRT) market continues to grow, it has become increasingly important to monitor the annuity market for plan sponsors that are considering transferring retiree pension obligations to an insurer. The MPBI uses the FTSE Above Median AA Curve, along with annuity purchase composite interest rates from insurers, to estimate the average cost of a PRT annuity de-risking strategy.

- Milliman analysis: Corporate pension funding ratio down to 82.2% in February thanks to market volatility, low discount rates

11 March 2020

Seattle - Milliman, Inc., a premier global consulting and actuarial firm, today released the results of its latest Pension Funding Index (PFI), which analyzes the 100 largest U.S. corporate pension plans. In February, discount rate declines combined with market volatility caused the PFI funding status to worsen by $71 billion, while the funded ratio for these plans dropped from 85.5% to 82.2% for the month. The last time the PFI funded ratio was this low was November 30, 2016.

- Milliman analysis: Public pension funding ratio hits three-year high in Q4 2019 at 74.9%, but February’s market volatility will likely erase some of those gains in Q1 2020

2 March 2020

Seattle - Milliman, Inc., a premier global consulting and actuarial firm, today released the fourth quarter 2019 results of its Public Pension Funding Index (PPFI), which consists of the nation’s 100 largest public defined benefit pension plans. During Q4 2019, the overall funded ratio for these plans climbed from 72.7% to 74.9%, which as of December 31 marks the highest quarterly result in the history of the PPFI. Comparatively, at the end of 2018, the Milliman PPFI funded ratio was at 67.2%.

- Milliman launches monthly Pension Buyout Index to track the estimated cost of retiree pension risk transfer transactions

27 February 2020

Seattle - Milliman, Inc., a premier global consulting and actuarial firm, today announced the launch of the new Milliman Pension Buyout Index (MPBI). As the Pension Risk Transfer (PRT) market continues to grow, it has become increasingly important to monitor the annuity market for plan sponsors that are considering transferring retiree pension obligations to an insurer.

- Milliman analysis: Multiemployer pension plans’ aggregate funding percentage reaches 85% in 2019, matching pre-financial crisis levels

25 February 2020

Seattle - Milliman, Inc., a premier global consulting and actuarial firm, today released the results of its latest Multiemployer Pension Funding Study (MPFS), which analyzes the funded status of all multiemployer defined benefit pension plans in the United States.

- Milliman adds IBEW Local 405 as a retirement services client

25 February 2020

Seattle - Milliman, Inc., one of the premier global consulting, actuarial, and benefits administration firms, today announced it has added the IBEW Local 405 Deferred Savings Plan as a defined contribution client. The plan includes 900 participants and $184 million in assets.

- Milliman and Enova announce strategic alliance providing next generation advanced analytic solutions to life insurance industry

24 February 2020

Seattle - Milliman, Inc., a premier global consulting and actuarial firm, and Enova Decisions, a leading financial technology and analytics company, today announced a strategic alliance aimed at bringing new advanced analytics to insurers. The alliance brings together Milliman’s deep domain expertise and data resources and Enova Decisions’ real-time analytic capabilities, giving insurers an innovative platform for retaining customers, optimizing sales operations, and maximizing the value of current and future customers.

- Milliman report on U.S. organ and tissue transplants projects 11% rise in average annual cost in 2020

19 February 2020

Seattle - Milliman, Inc., a premier global consulting and actuarial firm, today released the 2020 edition of its triennial report on the estimated costs of U.S. organ and tissue transplants. The report summarizes average annual costs per member per month (PMPM), including utilization and billed charges, related to the 30 days prior through 180 days after transplant admission for organ and tissue transplants. This includes single-organ transplants such as heart, intestine, kidney, liver, lung, and pancreas, and a number of multiple-organ transplants; tissue transplants include bone marrow and cornea.

- Milliman survey reveals 25 out of 28 companies use or plan to use accelerated underwriting in term life insurance

13 February 2020

Seattle -Milliman, Inc., a premier global consulting and actuarial firm, recently released the results of its biennial broad-based survey on term life insurance. The survey captured historical data for key industry competitors as well as company perspectives on a range of issues pertaining to these products into the future. The Term Life Insurance Issues report is based on a survey of 28 term insurance companies. It includes detailed information on underwriting trends and other product and actuarial issues such as sales, profit measures, target surplus, reserves, risk management, product design, compensation, and pricing.

- Milliman analysis: January’s discount rate hits 20-year record low, sending corporate pension funding plummeting

10 February 2020

Seattle - Milliman, Inc., a premier global consulting and actuarial firm, today released the results of its latest Pension Funding Index (PFI), which analyzes the 100 largest U.S. corporate pension plans. In January, steep discount rate declines caused the PFI funding deficit to swell by $73 billion; the funded ratio for these plans subsequently dropped from 89.0% to 85.7% for the month.

- Milliman analysis: Despite economic pressure on home price growth, low interest rates keep mortgage default risk low in 2019 Q3

4 February 2020

Seattle - Milliman, Inc., a premier global consulting and actuarial firm, today announced the third quarter 2019 results of the Milliman Mortgage Default Index (MMDI), which shows the latest monthly estimate of the lifetime default risk of U.S.-backed mortgages.

- Opportunity International and Milliman launch first Opportunity Zone innovation hub in Sub-Saharan Africa

3 February 2020

Chicago - Opportunity International and Milliman are working together to launch the first extreme poverty Opportunity Zone innovation hub in Uganda.

- Milliman MedInsight ranked best in KLAS for payer quality analytics for second year in a row

31 January 2020

Seattle - MedInsight, Milliman, Inc.’s highly regarded platform for data warehousing and healthcare analytics, ranked number one in the 2020 Best in KLAS: Software and Services report for Payer Quality and Risk Analytics.

- Milliman adds Ironworkers Local 8 as a retirement services client

21 January 2020

Seattle - Milliman, Inc., one of the premier global consulting, actuarial, and benefits administration firms, today announced it has added the Wisconsin Ironworkers Union Individual Account Retirement Fund as a defined contribution client. The plan includes over 3,300 participants and $215 million in assets.

- Milliman announces Thomas D. Snook Global Health Practice Director

8 January 2020

Seattle - Milliman, Inc., one of the premier global consulting and actuarial firms, today announced the election of Thomas D. Snook as the firm’s Global Health Practice Director.

- Milliman year-end analysis: Corporate pensions see an overall investment gain of 15.66% in 2019, but funding still drops due to discount rate lows

8 January 2020

Seattle - Milliman, Inc., a premier global consulting and actuarial firm, today released the year-end results of its latest Pension Funding Index (PFI), which analyzes the 100 largest U.S. corporate pension plans. In 2019, corporate pension funding ended down $30 billion for the year, with the funding ratio dropping from 89.4% at the end of 2018 to 89.0% as of December 31, 2019.

-

Milliman study: Steady Embedded Value (EV) growth story among Asia insurers in the first half of 2019

23 December 2019

Milliman, Inc., a premier global consulting and actuarial firm, today released its ‘2019 Mid-Year Embedded Value Results: Asia’ report. This update supplements the ‘2018 Embedded Value Results: Asia’ report, released in September 2019 and includes 2019 mid-year results posted by Asian insurers.

- Funded ratio for 100 largest U.S. public pensions climbs to 73.4%, according to Milliman estimates

23 December 2019

Seattle - Milliman, Inc., a premier global consulting and actuarial firm, today released the results of its 2019 Public Pension Funding Study (PPFS), which analyzes funding levels of the nation’s 100 largest public pension plans, including an independent assessment on the expected real return of each plan’s investments.

-

Milliman analysis: Corporate pension funding rises by $15 billion in November

5 December 2019

Milliman, Inc., a premier global consulting and actuarial firm, today released the results of its latest Pension Funding Index (PFI), which analyzes the 100 largest U.S. corporate pension plans. During November, the funded ratio for these plans rose slightly, from 86.1% to 86.8%, while the funded status deficit improved by $15 billion.

-

Individual disability income (IDI) market reports modest overall growth, according to Milliman

26 November 2019

Seattle - Individual disability income (IDI) market reports modest overall growth, according to Milliman 15 IDI market leaders record combined 2018 new premium sales of $401 million, growth rate of 1.5%

-

MBW International announces new partner to further enhance global services

18 November 2019

London – In response to client demand, MBW International, the leading independent alternative to the big three consulting firms for global pensions and employee benefits advice, has announced the addition of a third partner, Lurse. The organisation will become MBWL International with immediate effect.

-

Milliman analysis: Corporate pension funding rises by $11 billion in October

07 November 2019

Seattle - Milliman, Inc., a premier global consulting and actuarial firm, today released the results of its latest Pension Funding Index (PFI), which analyzes the 100 largest U.S. corporate pension plans. During October, the funded ratio for these plans rose slightly, from 85.4% to 86.1%, while the funded status deficit improved by $11 billion.

-

Milliman analysis: Default risk for government-backed mortgages decreases in 2019 Q2 as low interest rates spur borrowers to refinance

30 October 2019

Seattle – Milliman, Inc., a premier global consulting and actuarial firm, today announced the second quarter 2019 results of the Milliman Mortgage Default Index (MMDI), which shows the latest monthly estimate of the lifetime default risk of U.S.-backed mortgages. The goal of the MMDI is to provide a benchmark to understand trends in U.S. mortgage risk.

-

Milliman MedInsight Launches New MedInsight Provider Solution

22 October 2019

Seattle – MedInsight, Milliman, Inc.’s highly regarded platform for data warehousing and healthcare analytics, recently launched the newest release of its flagship product, the MedInsight Solutions. The newest release, called the MedInsight Provider Solution, was created in order to better serve and understand the performance of MedInsight’s over 100 providers.

We’re here to help

Ask the tough questions. We’re ready for them.